Henrico County’s Floodplain Management Program is responsible for managing the County’s participation in the National Flood Insurance Program (NFIP). A floodplain or flood-prone area is any land area susceptible to being inundated by water from any source other than a dam break. The Special Flood Hazard Area (SFHA) is an area that the Federal Emergency Management Agency (FEMA) or the County has identified as having special flood, mudflow, or flood-related erosion hazards based on a 100-year storm.

The National Flood Insurance Program

Henrico County has participated in the NFIP since the early 1980s, so that residents and businesses have access to flood insurance coverage as well as access to certain federal grants, loans, and disaster assistance. As a requirement for participation in the NFIP, special development considerations apply within the boundaries of an identified SFHA. The NFIP also mandates the purchase of flood insurance in an SFHA for properties utilizing federally backed financial assistance.

SFHAs in Henrico County may also be referred to as the 100-year floodplain or the one percent annual chance floodplain. This does not mean that a flood will only occur once every 100 years. There is a one-percent chance that this flood could occur in any given year, which means a flood could happen multiple times a year, several years in a row, or not at all for several years.

How is the County Addressing Flooding?

Managing the County’s NFIP participation includes reviewing permits for development in and near the floodplain; reviewing flood studies and map changes; and providing flood-related information to the public. Additionally, the Floodplain Management Program coordinates with several other County departments such as Planning; Building Inspections; Recreation and Parks; and other divisions of Public Works. Floodplain Management also coordinates with the Office of Emergency Management on flooding response and recovery efforts, hazard mitigation planning, and hazard mitigation grant opportunities.

Henrico County is actively working to join the NFIP’s Community Rating System (CRS). CRS is a program that rewards participating communities with discounted flood insurance premiums for residents. Communities are ranked by the NFIP on a scale from 1 to 10 based on their compliance with floodplain management standards, 1 being the highest score and 10 being the lowest. Based on their ranking, communities receive discounts on flood insurance that range from 5 to 45 percent.

Flood Facts in Henrico County

- There are approximately 1,500 residential and commercial structures that sit in floodplains in Henrico and many of them experience problems with drainage.

- Included in the 2021–22 proposed County budget is more than $1.5 million to help address floodplain and drainage issues.

- Most homeowners insurance does not cover flood damage, and FEMA estimates that one inch of water can result in more than $25,000 in damage.

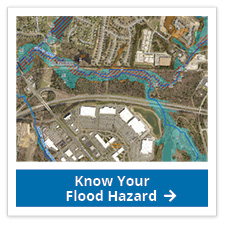

- The County has a detailed GIS map that shows flood zones.

- As sea levels rise and climate patterns change, there is an increased chance of flooding in Henrico County and other communities.

- Henrico’s floodplains take up nearly 24,000 acres of land. Approximately 88% of the floodplains are mapped by FEMA, while the remaining 12% are mapped by the County.

- The biggest recorded flood in Henrico took place in 1771 when the James River flooded, leading to 150 deaths as the river reached a record high of 45 feet above its normal level.