Tax relief program for seniors, disabled homeowners would build on REAP Program

Henrico County is proposing a tax relief program that would cap the real estate tax bills of qualifying homeowners who are older or disabled, helping to mitigate the higher costs associated with rising property values.

Proposed ordinance amendments that would establish the Real Estate CAP Program (RECAP) will be introduced at the request of the Board of Supervisors at its meeting tonight; a public hearing and vote are tentatively scheduled for Tuesday, Sept. 26. If approved, the program would be implemented in early 2024.

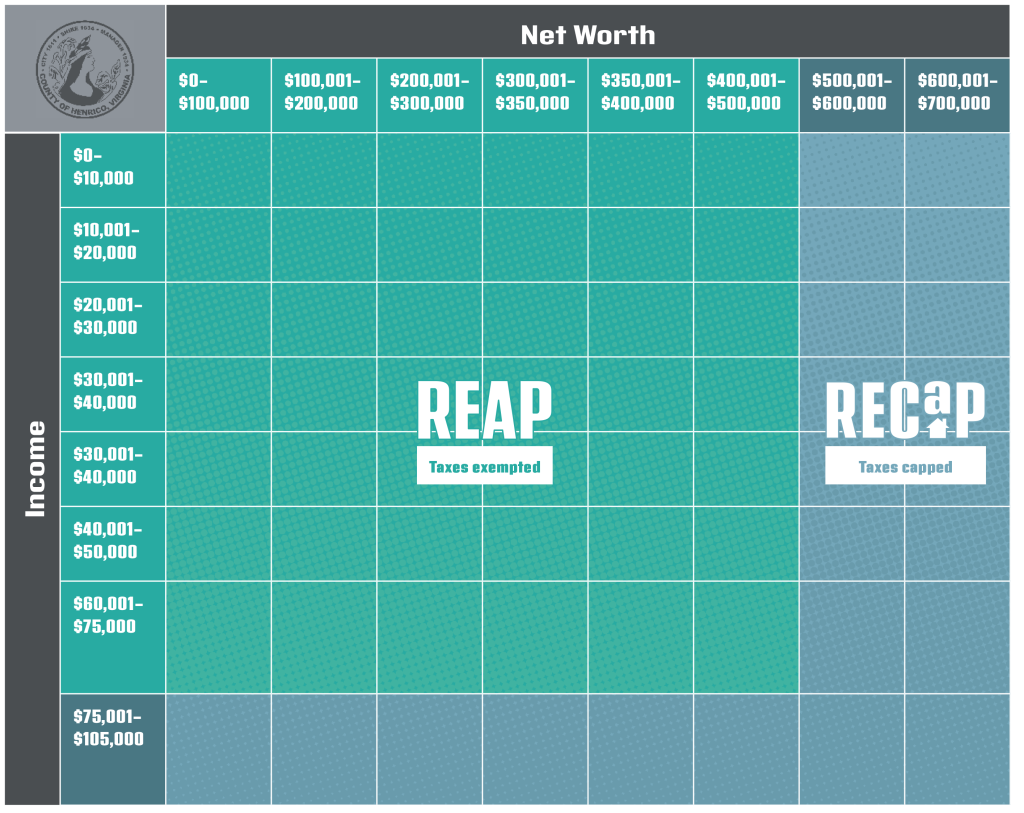

RECAP would build on Henrico’s Real Estate Advantage Program (REAP), which provides a real estate tax exemption of up to $3,200 for qualifying homeowners with a household income up to $75,000 and a net worth up to $500,000.

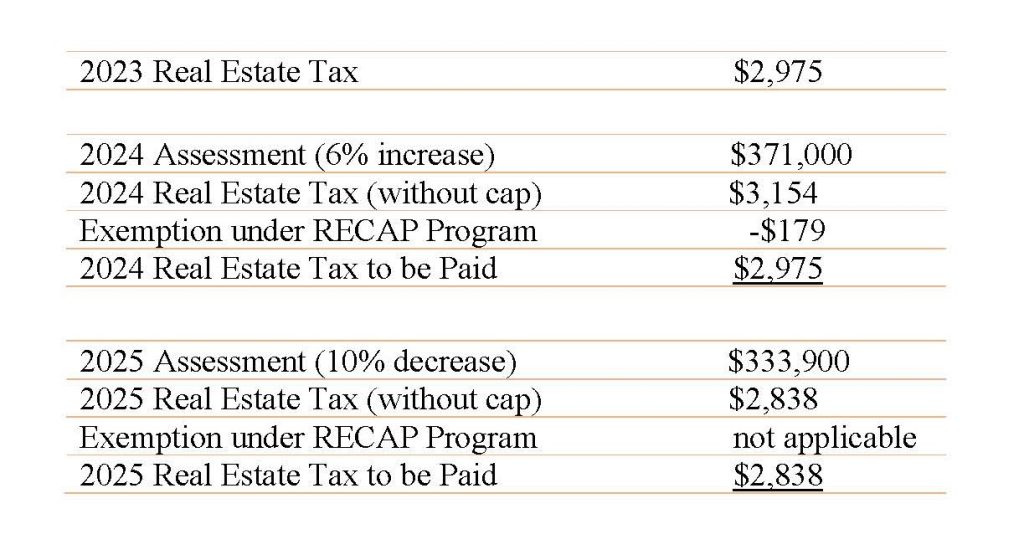

If approved, RECAP would lock in, or cap, the annual real estate tax bills of a qualifying homeowner so they never exceed the amount billed when they enter the program. In subsequent years, a participant would receive a real estate tax exemption equal to the difference between their new tax amount and their base year’s tax amount. In effect, tax bills would not increase for those who remain qualified, even if assessments rise.

“RECAP represents another bold step by Henrico County to protect our residents, particularly our seniors, from costs associated with higher property values,” Three Chopt District Supervisor Tommy M. Branin said. “As we worked on our budget this spring, it became clear that our new tax relief measures – specifically, another real estate tax credit and a lowering of the personal property tax rate – were only the start of what we needed to do. With RECAP, we will help provide predictability to our seniors’ expenses, which will be a great help to those living on fixed incomes.”

If a RECAP participant’s tax drops below the base year amount due to a lower assessed value or tax rate, their bill would reflect the lower amount. The homeowner would need to reapply to the program to establish the lower tax amount as their new base amount.

To qualify for RECAP, homeowners would need to be at least age 65 or totally and permanently disabled with a maximum household income of $105,000 and net worth of $700,000. Homeowners will be able to apply for RECAP and REAP on the same form.

“For 50 years, the Real Estate Advantage Program has provided meaningful tax relief to homeowners who are older or disabled,” said Board of Supervisors Chairman Frank J. Thornton, of the Fairfield District. “RECAP will be a great enhancement, as it will help insulate more of our seniors from the sometimes unpredictable impacts of rising home values. RECAP shows, once again, that Henrico is a county with heart.”

If approved, RECAP would build on Henrico’s recent tax relief measures that will total an estimated $26.3 million in 2023. This includes $11.2 million from a real estate tax credit; $3.6 million from a personal property tax rate cut and $11.5 million from the Real Estate Advantage Program.

###

Here’s a hypothetical example of how the Real Estate CAP Program would work for a qualifying resident who enters the program in 2023 when their home is assessed at $350,000. Henrico’s real estate tax rate is 85 cents per $100 of assessed value.