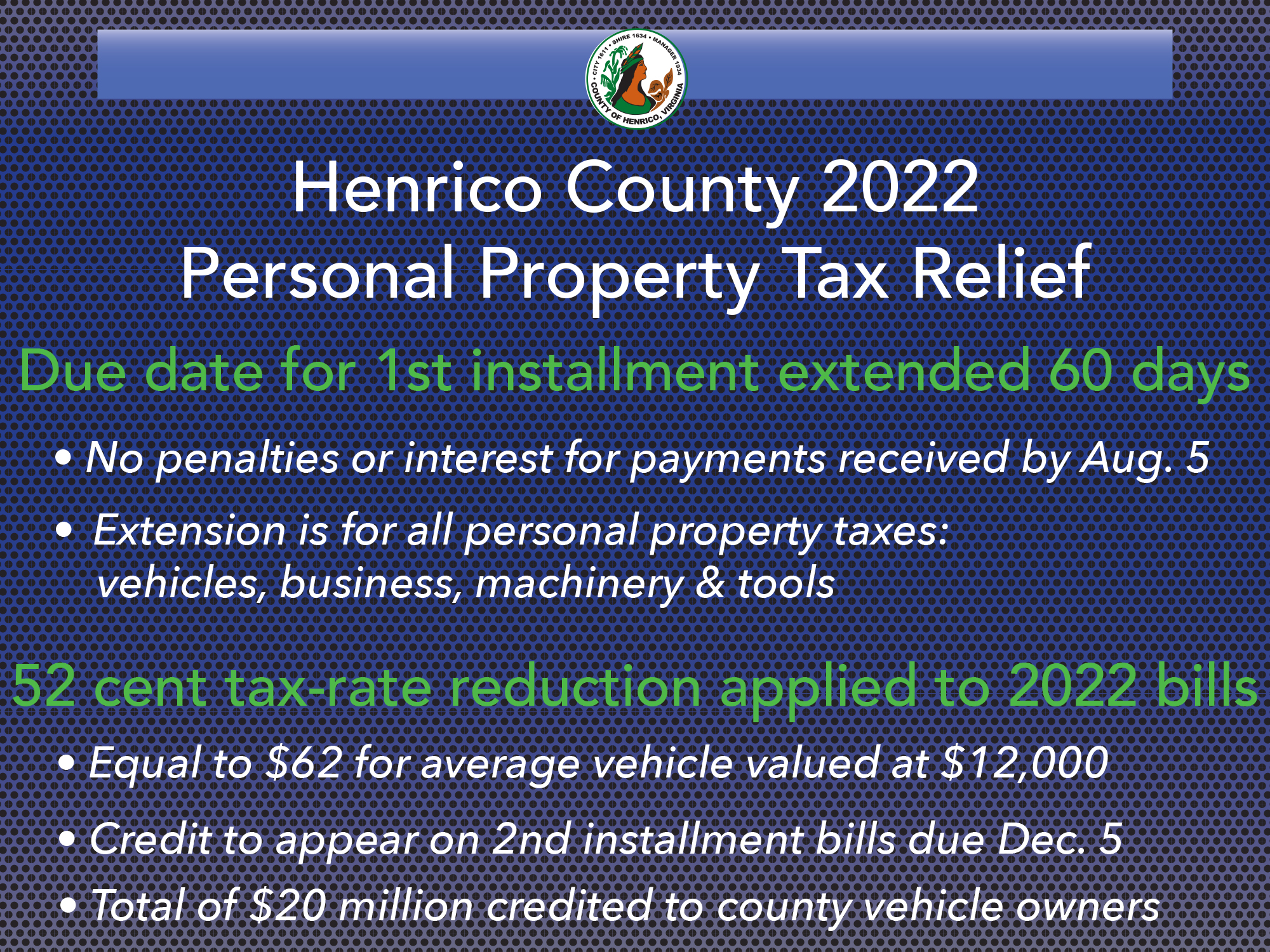

Plan would give a credit based on a 52-cent rate cut, make 1st payments due Aug. 5

The Henrico County Board of Supervisors will consider a personal property tax relief proposal that would give residents an additional 60 days to make their first payments and provide a credit on year-end bills to offset higher-than-expected vehicle values. With the credits, the county would provide an effective 52-cent reduction to the personal property tax rate for 2022, based on current estimates.

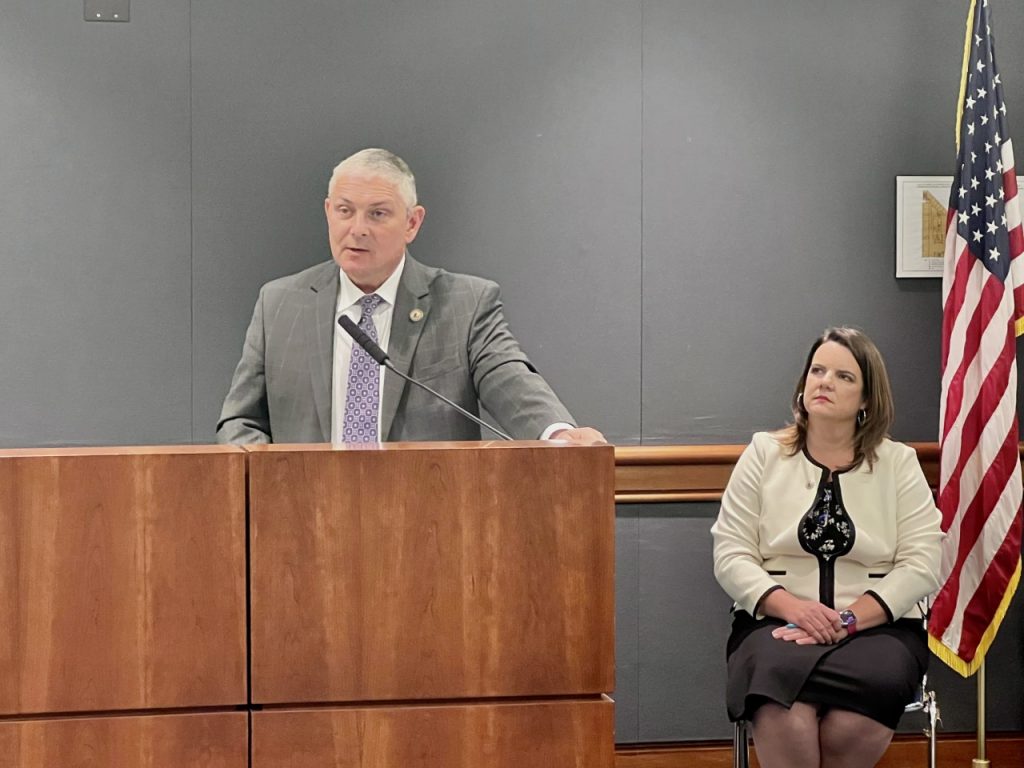

In outlining the plan in a news conference today, officials said the Board of Supervisors will vote Tuesday, May 10 on an emergency ordinance that would delay by two months – from June 6 to Aug. 5 – the due date for the first installment of all personal property taxes without penalties or interest.

The Board will act on the plan’s second part this summer. Enabled by a law signed by Gov. Glenn Youngkin in April and effective July 1, the proposal would direct the county to return surplus personal property tax revenues to the owners of qualifying vehicles, specifically automobiles, trucks and motorcycles. While the exact amount will not be known until accounts are reconciled after fiscal year 2021-22 ends June 30, officials currently would expect to return a surplus of $20.4 million, effectively reducing the personal property tax rate by 52 cents for the year – from $3.50 to $2.98 per $100 of assessed value. Individual credits would be applied to the second installment of personal property bills, due Dec. 5, and would provide a reduction of $62.40 for the owner of the average vehicle valued at approximately $12,000.

“This is not the county’s money,” County Manager John A. Vithoulkas said. “We did not anticipate it or budget it. It belongs to our taxpayers. Just as they did with the unanticipated real estate revenue, our supervisors want to return this money – every single penny – to its rightful owners, the taxpayers of Henrico County.”

Officials had projected personal property tax revenues to increase by 15% when they drafted the county’s budget for fiscal 2022-23. However, the increase now stands at 35% – or $20.4 million above projections – due to higher-than-expected vehicle values stemming from supply chain disruptions and other economic forces from the COVID-19 pandemic. Henrico uses a national pricing guide, as required by Virginia law, to assign vehicle values before issuing personal property tax bills.

With the personal property tax relief proposal and earlier initiatives, Henrico would provide its residents with a total of $51 million in tax relief in 2022.

This spring, the Board of Supervisors approved the 2+2 Plan, which is providing $20 million in real estate tax relief to soften the impacts of higher home values. Using a 2005 state law allowing a return of surplus real estate tax revenues, the county gave property owners a tax credit equal to a 2-cent reduction on the real estate tax rate. In addition, as part of the fiscal 2022-23 budget, the Board cut the real estate tax rate by 2 cents, from 87 cents to 85 cents per $100 of assessed value.

Henrico also is providing $11 million in tax relief through its Real Estate Advantage Program for residents who are ages 65 and older or permanently and totally disabled. The Board expanded the program for fiscal 2022-23 to allow qualifying residents with a maximum net worth of $500,000, up from $400,000.

Vithoulkas noted that Henrico’s real estate and personal property tax rates are already the lowest among the region’s large localities and that the county uses the overall lowest set of values from J.D. Power’s pricing guide for the purposes of vehicle assessments. Henrico also is believed to be the first locality poised to return surplus real estate and personal property tax revenues to taxpayers in the same year.

“The bottom line is Henrico is committed to keeping taxes low and pushing them lower,” Vithoulkas said. “We are committed to being good stewards and doing what is right by our taxpayers. That is our promise.”