UPDATE, Feb. 22, 2022:

At its regular meeting tonight, the Board of Supervisors approved the ordinance giving county property owners a one-time credit on their real estate taxes. With the measure, Henrico becomes the first locality in Virginia to refund real estate taxes to property owners.

Original release posted Jan. 26, 2022

Board of Supervisors also will consider 2-cent rate reduction with FY23 budget

The Henrico County Board of Supervisors on Tuesday welcomed a proposal that would give property owners a one-time credit on their real estate taxes.

County Manager John A. Vithoulkas announced the tax credit as part of a proposal, called “2+2,” during the 2021 State of the County address in December. He said the credit and a proposed 2-cent reduction of the real estate tax rate would help taxpayers manage the impact of sharply rising real estate values, which lead to increased assessments. Home prices have jumped by 30% to 50% in some areas of the county. By law, local real estate assessments must reflect 100% of a property’s fair market value.

With the introduction of a proposed ordinance Tuesday, the Board of Supervisors scheduled a public hearing and a potential vote for Feb. 22 on the real estate tax credit. Henrico could be the first locality in Virginia to return surplus real estate taxes to property owners under a 2005 state law, officials said.

“This is yet another way that Henrico is demonstrating our financial stewardship and transparency to our citizens,” said Sheila Minor, director of the Department of Finance. “The county collected real estate revenue last fiscal year in excess of the budget and provided an exceptional level of service to our citizens, even during a pandemic. We expect to continue those trends in the current fiscal year. Given the real estate market, the county wants to provide real tax relief to those who are seeing their property values increase.”

If the credit is approved, homeowners and other property owners would receive an amount equal to 2 cents per $100 of their real estate’s taxable value for 2022. For example, a home with the average assessed value of $322,200 would generate a credit of $64.44. ($322,200/100 x .02=$64.44)

Credits of $30 or more would be paid by checks issued in early March. Smaller amounts would be credited directly on real estate tax bills for 2022. For property owners who owe delinquent taxes, the credit would be applied to the outstanding balance and to any future bills if the credit exceeds the current amount due.

Property owners who pay their taxes through an escrow account – for example, as part of their mortgage – may not see their credit reflected until later in the year, when accounts are reconciled. Finance plans to establish in March a phone number to call if taxpayers have questions about their credit or tax bill.

The Board of Supervisors will consider the 2-cent real estate tax rate reduction when it adopts a budget for fiscal 2022-23. The recommended budget, which will be presented to the Board of Supervisors in March, will be balanced on a real estate tax rate of 85 cents, down from the current rate of 87 cents.

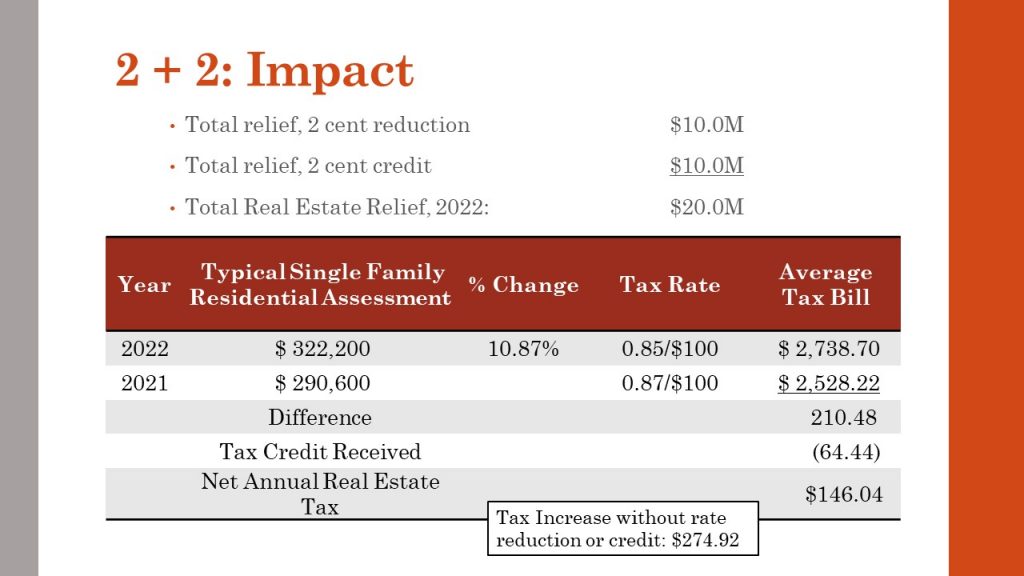

If approved, the 85-cent rate would be reflected on real estate tax bills issued in April and October. By cutting the rate, Henrico would forgo $10 million in revenue that otherwise would have been collected. With an additional $10 million returned to taxpayers via the credit, the combined tax relief offered through the 2+2 proposal would total $20 million.

Henrico’s average assessed home value is $322,200 in 2022, an increase from $290,600 in 2021. Based on those values, a homeowner would face an increase in real estate taxes of $275 without the credit and rate reduction. With the tax relief proposals, the average tax bill would total $2,674, reflecting a smaller increase of $146.